Meezan Bank Easy Home 2025 – Mera Ghar Mera Ashiana

“Mera Ghar, Mera Ashiana” is Pakistan’s new important Islamic cover finance preparation launched in 2025. The aim is to help low and middle income Pakistanis build or buy homes under Shariah-compliant terms. Meezan Bank is offering this scheme under its “Easy Home – Mera Ghar Mera Ashiana” product. The organization and State Bank of Pakistan (SBP) provide markup subsidies and risk sharing to make it reasonable. In this object you determination find complete A to Z detail: features, eligibility, text checklist, appeal process, rates and subsidy, benefits, and shared pitfalls.

Meezan Bank Easy Home 2025 – Mera Ghar Mera Ashiana

| Item | Detail | Notes |

|---|---|---|

| Scheme Name | Mera Ghar – Mera Ashiana (MGMA) | Also called “Easy Home – Mera Ghar Mera Ashiana” by Meezan Bank |

| Launch Date | 24 September 2025 | Government officially launched the initiative |

| Endorsement / Partner | Government of Pakistan & SBP; Participating banks | SBP provides subsidy and risk sharing |

| Maximum Tenure | 20 years | Under scheme rules |

| Tiers & Rates | Tier 1: up to PKR 2 million at 5%; Tier 2: above 2M to up to 3.5M at 8% | Fixed end-user rate for first 10 years |

| Buyer’s Minimum Equity | 10% of property value | Buyer must contribute at least 10% share |

| Application Method | Via participating banks, Islamic banks, microfinance banks, HBFCL | Loans offered via banks nationwide |

Why This Scheme Was Launched & Its Objective

Pakistan faces a huge housing shortage—lots of families lack formal cover. Traditional loans or financing frequently are high-priced or interest-based, making them inappropriate for many. The government presented Meezan Bank Relaxed Home 2025 – Mera Ghar Mera Ashiana as a markup subsidy & risk sharing scheme to:

- Make home financing affordable for middle and lower income groups

- Provide Shariah-compliant financing so no conventional interest (Riba)

- Encourage banks and financial institutions to enter the affordable housing sector

- Reduce the housing gap and stimulate construction

These goals make the Meezan Bank Easy Home 2025 – Mera Ghar Mera Ashiana scheme more than just a loan product—it is a public policy to boost home ownership.

Key Features & Structure of the Scheme

Shariah Method – Diminishing Musharakah

This Meezan Bank Easy Home 2025 – Mera Ghar Mera Ashiana scheme is based on Diminishing Musharakah (joint ownership). Under this:

- The buyer and bank jointly own the property.

- The buyer pays rent for the bank’s share while gradually purchasing that share.

- Over time, the buyer becomes sole owner.

This ensures the transaction is not a conventional interest-bearing loan.

Tiered Financing & Markup / Rates

- Tier 1: Loans up to PKR 2 million — fixed 5% rate (for first 10 years)

- Tier 2: Loans above 2M to 3.5M — fixed 8% (for first 10 years)

- After the first 10 years, rate becomes variable (likely KIBOR + 3%) depending on market conditions.

- For first 10 years, the government subsidizes part of markup to make it affordable.

Eligible Property Types & Size Limits

- House / residential unit up to 5 Marla

- Apartment / flat up to 1,360 sq ft

These limits ensure the scheme targets modest housing, not luxury properties.

Equity / Down Payment & Bank Share

- Buyer must contribute at least 10% of property value as their share

- Bank finances the remaining (up to 90%)

- Over time, buyer purchases bank’s share via periodic installments.

Risk Sharing & First Loss Guarantee

- The government offers 10% first-loss coverage for banks’ outstanding portfolios under the scheme to reduce risk and encourage bank participation.

- Participating financial institutions must adhere to SBP rules and avoid misuse.

No Processing Charges / Prepayment Penalties

One attractive feature: no processing charges or penalties if the buyer repays early. This removes common hidden cost barriers.

Eligibility Criteria – Who Can Apply?

To apply under Mera Ghar – Mera Ashiana, you must satisfy:

Citizenship & Property Ownership

- Must be a resident Pakistani national with valid CNIC

- Must be a first-time homebuyer (i.e., you or your family should not already own a residential house or plot for residence)

Age & Income / Employment

- Minimum age: 20 years

- Maximum age: 65 years or up to retirement age, whichever is earlier

- Employment / income proof:

- If salaried: proof of employment, salary slips, bank statements

- If self-employed: business documents, tax returns

- Income clubbing / co-applicants: immediate family members (spouse, children, parents, siblings) may be co-applicants, and incomes can be pooled to meet criteria.

Credit / Financial Standing

- No recent defaults or negative history in the credit bureau or e-CIB should exist

- Must pass the bank’s internal credit checks and verification of property documents

Required Documents Checklist

Prepare these when applying:

- Copy of applicant’s CNIC (and co-applicant, if any)

- Recent photographs

- Proof of income / employment (salary slips, bank statements, business documents)

- Property documents: ownership, title, legal clearances, mutation, NOCs

- Appraisal / valuation report for the property

- Bank statements or tax returns (for self-employed)

- Fully filled application form from bank

Having all documents in order helps speed up approvals.

Application Process – Step by Step

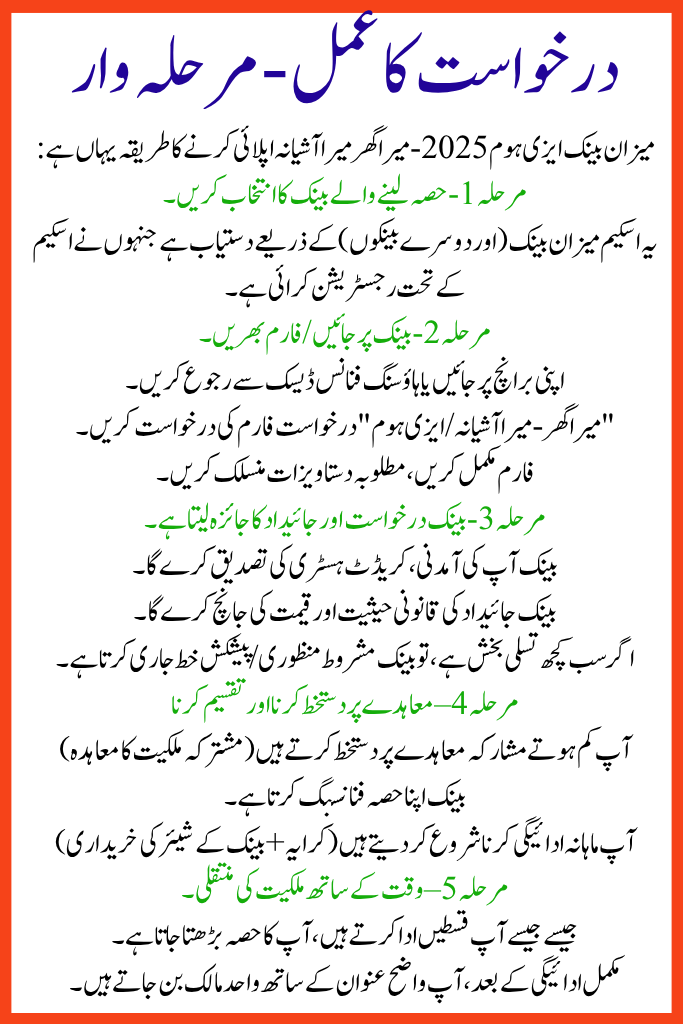

Here is how to Meezan Bank Easy Home 2025 – Mera Ghar Mera Ashiana apply:

Step 1 – Choose a Participating Bank

The scheme is available through Meezan Bank (and other banks) that have registered under the scheme.

Step 2 – Visit Bank / Fill Form

- Visit your branch or approach the housing finance desk

- Request the “Mera Ghar – Mera Ashiana / Easy Home” application form

- Complete the form, attach required documents

Step 3 – Bank Reviews Application & Property

- Bank will verify your income, credit history

- Bank will check property’s legal status and valuation

- If all is satisfactory, bank issues a conditional approval / offer letter

Step 4 – Signing Agreement & Disbursement

- You sign the Diminishing Musharakah agreement (joint ownership contract)

- Bank disburses its share of financing

- You begin making monthly payments (rent + purchase of bank’s share)

Step 5 – Ownership Transfer Over Time

- As you pay installments, your share increases

- After full payment, you become the sole owner with clear title

Benefits & Advantages of the Scheme

- Affordable markups: 5% or 8%, lower than usual mortgage rates

- No hidden charges: no processing fees, no prepayment penalties

- Shariah-compliant: structured with Diminishing Musharakah

- Long tenure: up to 20 years makes monthly payments manageable

- Low equity requirement: only 10% down payment

- Risk support for banks: government covers first-loss portion, encouraging wide adoption

- Encourages formal housing finance: more people may access legal housing

Challenges, Risks & Things to Watch

- The fixed rate applies only for first 10 years; variable rate thereafter may rise

- Bank approval / credit risk: applicants with weak credit may be rejected

- Property issues: legal or title defects may block financing

- Limited to small / modest homes: not for luxury or large estates

- Awareness and access: many people may not know about the scheme or participating branches

- Implementation delays: banks and branches must be ready to process efficiently

Recent Developments & Official Announcements

- The Meezan Bank Easy Home 2025 – Mera Ghar Mera Ashiana scheme was launched 24 September 2025 with full support from government and SBP.

- Financing is made available via all commercial banks, Islamic banks, microfinance banks, and House Building Finance Company (HBFCL).

- Officially, Tier 1 (≤ PKR 2 million) is at 5%, and Tier 2 (2M to 3.5M) is at 8% for first 10 years.

- The government also announced no processing fees and no prepayment penalty to boost uptake.

FAQs- Meezan Bank Easy Home 2025 – Mera Ghar Mera Ashiana

Can someone who already owns a plot apply?

Yes, if you plan to concept the home on that conspiracy and you do not previously own a residential structure. The scheme allows edifice on own land.

Can I repay early / buy bank’s share early?

Yes — prepayment is allowed without penalties. You may buy the remaining share as per contract terms.

What happens after 10 years when fixed rate ends?

After first 10 years, markup becomes variable, likely tied to 1-year KIBOR + 3%.

Is the scheme available all over Pakistan?

Yes, via all participating banks across Pakistan. Meezan Bank offers it in all its branch network.

Who qualifies as a co-applicant?

Immediate family members (spouse, parents, children, siblings) can be co-applicants to pool income.

What is first-loss coverage by government?

Government will shelter the first 10% loss on unresolved portfolios to defend banks if repayments evasion. Encourages banks to lend under scheme.

Conclusion & Advice to Applicants

Meezan Bank Easy Home 2025 – Mera Ghar Mera Ashiana is a milestone scheme pointing to bridge Pakistan’s covering gap. Its structure—Shariah-based, backed for first 10 years, long tenure, and shy down sum—makes homeownership more truthful for regular citizens.

If you plan to apply:

- Check that you do not already own a residential property

- Ensure your documents, revenue proof, credit ancient times are clean

- Visit a participating bank branch and request the application form

- Ask for written agreements and full clarity on how rates will shift after year 10

- Choose a stuff within limits (max 5 marla or 1,360 sq ft)

- Keep in mind, variable rates and market variations may affect upcoming expenditures